A Biased View of Feie Calculator

Table of ContentsThe 2-Minute Rule for Feie CalculatorThe Best Strategy To Use For Feie CalculatorAll about Feie CalculatorThe Basic Principles Of Feie Calculator The smart Trick of Feie Calculator That Nobody is Discussing

He sold his United state home to develop his intent to live abroad completely and used for a Mexican residency visa with his other half to assist satisfy the Bona Fide Residency Test. Furthermore, Neil secured a lasting residential or commercial property lease in Mexico, with plans to ultimately purchase a residential property. "I currently have a six-month lease on a home in Mexico that I can expand an additional 6 months, with the objective to get a home down there." Nevertheless, Neil mentions that purchasing residential or commercial property abroad can be challenging without initial experiencing the place."We'll absolutely be outdoors of that. Even if we come back to the United States for medical professional's visits or service calls, I doubt we'll invest greater than thirty day in the US in any kind of given 12-month duration." Neil emphasizes the value of rigorous monitoring of U.S. gos to (FEIE calculator). "It's something that people need to be really thorough concerning," he claims, and advises expats to be careful of usual blunders, such as overstaying in the united state

About Feie Calculator

tax obligation obligations. "The reason that united state tax on around the world earnings is such a big bargain is since many individuals forget they're still subject to united state tax obligation also after transferring." The united state is just one of the couple of countries that taxes its citizens no matter of where they live, implying that also if an expat has no revenue from U.S.

tax return. "The Foreign Tax obligation Debt enables individuals operating in high-tax nations like the UK to counter their U.S. tax obligation obligation by the amount they have actually already paid in taxes abroad," claims Lewis. This ensures that deportees are not strained two times on the same income. However, those in reduced- or no-tax countries, such as the UAE or Singapore, face additional difficulties.

The Of Feie Calculator

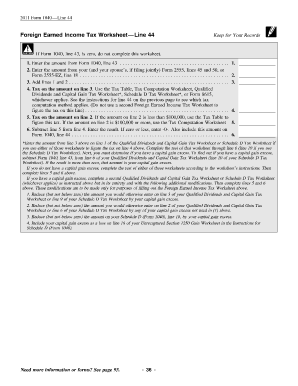

Below are a few of the most often asked questions regarding the FEIE and other exclusions The Foreign Earned Revenue Exemption (FEIE) allows united state taxpayers to omit as much as $130,000 of foreign-earned revenue from federal earnings tax, lowering their united state tax obligation responsibility. To receive FEIE, you need to satisfy either the Physical Existence Test (330 days abroad) or the Bona Fide Home Test (verify your main home in an international nation for a whole tax obligation year).

The Physical Presence Examination needs you to be outside the U.S. for 330 days within a 12-month period. The Physical Existence Test also requires united state taxpayers to have both an international earnings and a foreign tax home. A tax home is specified as your prime location for service or work, despite your household's home.

The 9-Minute Rule for Feie Calculator

An earnings tax obligation treaty between the U.S. and an additional country can help protect against double tax. While the Foreign Earned Income Exclusion reduces taxed revenue, a treaty may supply added benefits for qualified taxpayers abroad. FBAR (Foreign Checking Account Record) is a needed declare U.S. people with over $10,000 in foreign monetary accounts.

Qualification for FEIE depends on meeting certain residency or physical presence tests. is a tax consultant on the Harness system and the owner of Chessis Tax obligation. He belongs to the National Organization of Enrolled Agents, the Texas Culture of Enrolled Representatives, and the Texas Society of CPAs. He brings over a decade of experience helping Huge 4 companies, advising expatriates and high-net-worth individuals.

Neil Johnson, CPA, is a tax expert on the Harness platform and the founder of The Tax obligation Guy. He has more than thirty years of experience and now focuses on CFO services, equity payment, copyright taxation, marijuana taxation and divorce related tax/financial planning issues. He is an expat based in Mexico - https://www.4shared.com/u/lv_2m1o8/louisbarnes09.html.

The foreign made revenue exclusions, in some cases referred to as the Sec. 911 exemptions, omit tax on wages made from functioning abroad.

Feie Calculator for Beginners

The tax benefit excludes the revenue from tax at bottom tax obligation prices. Formerly, the exemptions "came off the top" decreasing income subject to tax obligation at the top tax prices.

These exemptions do not excuse the incomes from US taxation yet just supply a tax obligation decrease. Note that a bachelor working abroad for every one of 2025 who made regarding $145,000 with no various other revenue will have taxable revenue lowered to no - effectively the exact same solution as being "tax cost-free." The exclusions are computed each day.